October 10, 2012 (DJIA 13,473.53, S&P500 1,441.48)

In this note I will mention some of the companies we own, yet please understand that none of the companies mentioned in this note are any way a solicitation or recommendation to invest in these or any companies. Please read the disclaimer at the bottom of this note.

Our portfolios are positioned in what I think will continue to be long term holdings. I know the companies fairly well in our portfolios, and often I have known these companies for a long time. I think our companies are fairly priced to either normalized earnings and cash flow, or to some other value metric.

Our largest holding continues to be National Western Life (NWLI $142.00). I would suggest that anyone who wants to see examples of my research, methods and thought process, should read my thesis on NWLI. Here is a link

https://www.rbcpa.com/wp-content/uploads/2016/12/NWLI_Notes.pdf

We continue to emphasize utilities in our portfolios. I find that utilities are a more defensive way to diversify from traditional common stocks. This does not mean that utilities do not carry risk to the value of our investment. We are using utilities as a semi-surrogate to traditional fixed income. The average yield of our utility portfolio is around 5.0%. This compares to the ten year treasury price of 1.739%. The thirty year treasury is currently priced at 2.952%.

Here is a table of our current utility holdings:

| Company | Price | Dividend Yield |

|---|---|---|

| Ameren | 32.81 | 4.877% |

| Entergy | 70.69 | 4.697% |

| Exelon | 36.14 | 5.811% |

| PPL | 29.32 | 4.911% |

| Public Service Enterprise Group | 32.46 | 4.375% |

| Teco Energy | 17.66 | 4.983% |

Our 10 largest holdings are:

| Company | Price | Dividend Yield |

|---|---|---|

| National Western Life | 142.00 | 0.254% |

| Microsoft | 29.28 | 3.142% |

| Wal-Mart | 74.14 | 2.145% |

| Public Service Enterprise Group | 32.46 | 4.375% |

| Pfizer | 25.31 | 3.477% |

| Exxon | 92.13 | 2.475% |

| JP Morgan Chase | 41.38 | 2.900% |

| Merck | 46.17 | 3.640% |

| Exelon | 36.14 | 5.811% |

| Entergy | 70.69 | 4.697% |

Some thoughts and observations

- I was at an investment conference yesterday, and investors were asked why they invest in certain companies, or why they would own a company. As the room was surveyed, I noticed that most people in the room were not concerned with the price of the company they were discussing. Price is so important to value investing. Price discipline can not be over-emphasized. I think this anomaly is the main reason that value investing works. Some of the company’s we own are not owned by others because of their past stock performance. These companies would include Microsoft (29.05), Wal-Mart (74.89) and National Western Life (142.00). All three of these companies have lagged the market (at least until recently), yet operationally they have been consistent positive performers, and have all increased shareholder value. I look for situations where people have stopped thinking and become blind to new evidence.

- We do not have much if any at all fixed income in our portfolios. I am concerned with low interest rates, and possible future inflation, which could quickly erode the value of a fixed income portfolio. You can search our site with the term “fixed income” in quotes, and see my prior views on this subject.

- I do believe that the economy is turning around. Much of our difficulty is coming from the economic situation in Europe, as well as a slow down in China. I think we will see a world wide appreciation of America by other Sovereigns. I think some of the unemployment we are experiencing is based on a paradigm shift in use of technology and innovation.

- I think the US Government should identify all necessary infrastructure capital improvement programs over the next decade. We can currently borrow on those planned expenditures at very low interest rates. I emphasize the term of “necessary programs.” These are expenditures that would have occurred in the future, and be funded by debt, but we would be able to capture low rates, and put people back to work now. This suggestion does not include free spending and projects that are not necessary. USA should look to restructure as much current debt as possible into long term debt. Current 30 year Treasury rates are under 3%.

- A value investor needs a capacity to suffer.

- Always realize the future is uncertain.

- Don’t rely on prediction of doom or success. Economies will weather storms. Watch the historic means.

- The most important leading indicator will be rising employment.

- Stocks are good to own in inflation. There are caveats to that, such as hyper inflation and excessive valuations.

Please let me know if you want to discuss any of your finances, portfolios, or anything like that.

Disclaimer

If you are a client of ours, and if you have questions regarding the company or investment mentioned in this report please call our office. If you are not a client of Redfield, Blonsky & Co. LLC Investment Management Division and are reading these notes, we urge you to do your own research. We will not be responsible for any person making an investment decision based on these notes. These notes are a “by-product” of our research. We are not responsible for the accuracy of these notes. We are not responsible for errors that may occur in these notes. Please do not rely on us to monitor or update this or any other report we may issue. In theory, we could come across some type of data or idea, which causes us to eliminate our long or short position of the company or investment mentioned in this report from our portfolios. We will not notify reader’s revisions to these notes. We are not responsible to keep readers of these notes updated for changes or material errors or for any reason whatsoever. We manage portfolios for clients, and those clients are our greatest concern as it relates to investing. Certain clients of Redfield, Blonsky & Co LLC may not have the company or investment mentioned in this report in their portfolios. There could be various reasons for this. Again, if you would like to discuss the company or investment mentioned in this report , please contact Ronald R. Redfield, CPA, PFS (partner in charge of investment management division).

Information herein is believed to be reliable, but its accuracy and completeness cannot be guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to change without notice. This publication is provided to you for information

Important Disclosures

- Redfield, Blonsky & Co., LLC (RBCo), only transacts business in states where it is properly registered, or excluded or exempted from registration requirements.

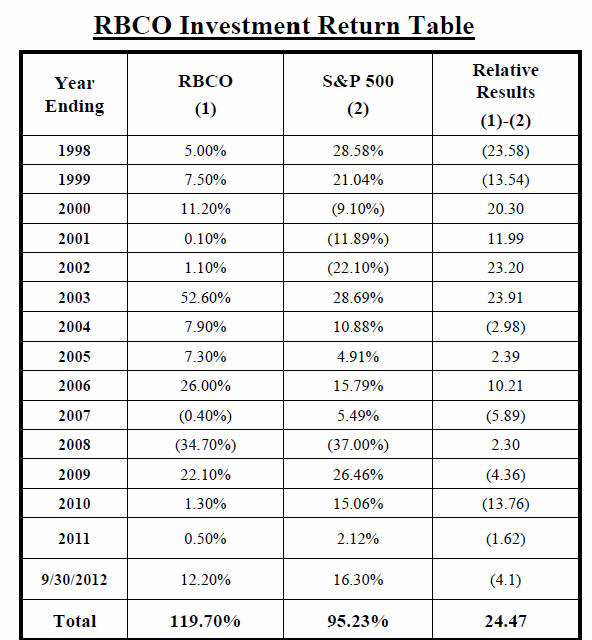

- Past performance assumes reinvestment of dividends and other distributions and may not be indicative of future results. Therefore, no current or prospective client should assume that the future performance of any specific investment, investment strategy (including the investments and/or investment strategies recommended and/or purchased by adviser), or product made reference to directly or indirectly in this presentation or on our website, or indirectly via a link to any third-party website, will be profitable or equal to corresponding indicated performance levels. The investment return and principal value of an investment will fluctuate and, when redeemed, may be worth more or less than their original cost.

- Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. No client or prospective client should assume that information presented is a substitute for personalized individual advice from the adviser or any other investment professional.

- Historical performance results for investment indexes, such as the S&P 500, generally do not reflect the deduction of transaction and/or custodial charges or the deduction of an investment-management fee, the incurrence of which would have the effect of decreasing historical performance results of the S&P 500 Index. Whenever RBCO performance is referred to, results have been reduced by all fees, including RBCO management fee.

- Returns for the RBCO portfolios have been calculated using actual time-weighted returns obtained from all accounts over the time periods indicated. All RBCO returns assume the reinvestment of dividends and are shown net of the investment management fees and all other expenses. Please see our form ADV for a full fee disclosure. Actual individual account performance may be materially different from our composite results.

- RBCO files an annual form ADV, which includes an easy to read brochure. Form ADV is a valuable read for anyone interested in learning more about RBCO. Additional information about Redfield, Blonsky & Co., LLC is also available on the SEC’s website at http://www.adviserinfo.sec.gov . The searchable IARD/CRD number for Redfield, Blonsky & Co., LLC is 128714.

- The S&P 500 Index is a widely recognized, unmanaged index of 500 of the largest companies in the United States as measured by market capitalization. The S&P 500 Index performance assumes reinvestment of all dividends and distributions and does not reflect any charges for investment management fees or transaction expenses, nor does the Index reflect any effects of taxes, fees or other types of charges and expenses. The S&P 500 Index is one of many indices and is not necessarily the most appropriate index when comparing performance results.