November 17, 2015 Ron’s Discussion Sheet that he used to present our 2015 Investor Conference

DJIA 17,490

S&P 500 2050

November 17, 2015

You can see a copy of our conference handout at this link: RBS_2015_Investment_Conference_version_Final.pdf

The following are notes I used for our 2015 annual investment conference.

1. Thank you all for coming. I find this annual event to be important for our clients, or even if not a client, an investor who is looking to learn more about the process of investing. This evening should give anyone added insight of what it is like investing with us, working with us, or even potentially working with us. It gives an investor an opportunity to ask us any questions about our process, our thoughts on our portfolios, as well as potentially have us answer as many investment questions as you might have.

I am incredibly cognizant as to our duty to our clients. We have an intense responsibility, and we take that responsibility very seriously. We are stewards of your capital, and will always put your portfolio in front of anything else. We are concerned with what we think is best for your portfolio, and not was is best for our firm. Yet, we do acknowledge that this thinking is a seed for future growth of our firm, as a client might give us more money, or suggest a colleague or such to invest with us.

During this conference you will probably see me look through my notes. I do this, as I have never had a memory for specific details, and hence I always keep detailed notes. I carry a note book or an app to constantly remind me of things. Our website is also a source of reference for me, as I often refer to it to find a site I have liked and found important. I keep detailed checklists, to-do notes, and so forth. I know myself, and hence explaining to you why I might not know an answer off the top of my head.

2. I think we are in a decent period for selective investing. We have seen price contraction in utilities and energy, which for the patient investor could blossom into positive future returns. I do not think that our investments are especially expensive, based on current interest rates, even rising interest rates. The value metrics we have used throughout our history, such as P/E, P/B are at lower than typical historical norms. Specific examples would be the banking and financial services sector.

3. Price Earnings ratios, although low for the holdings we own, certainly could contract. Yet, I do not believe that one can time the market, and if all of a sudden price earnings ratios became single digits in mass, it would be largely unavoidable. I study these situations daily, but many things in investing are beyond the investor’s control. Hence our typical focus on companies that have strong finances, what we think are sustainable dividends, and valuations that are not historically expensive (in fact, often inexpensive).

4. We are typically long term buyers and holders, as is evident by only 2 eliminations from our portfolios so far this year. One elimination was PPL, where our price objective was met, and we were looking to deploy in other situations. The other elimination was NWLI, which has been one of our favorite holdings for years, but I became concerned (probably an unjust concern) of a lawsuit by the country of Brazil. I did not want to be in a potential mind field with NWLI, and hence we exited our position. NWLI only trades about 6000 shares a day, and the holding became a concern of mine. I would love to own both of these companies again, and perhaps we will.

Yet, long term buy and hold intention, does not mean we put our head in the sand. We are constantly looking for clues where our thesis on ownership becomes disturbed. Typically, other than valuation, do we see a reason to sell a company we own, but as I mentioned above, these situations do occur.

Warren Buffett’s long-time partner Charlie Munger identifies that the most difficult process for a value investor is typically “doing nothing, or sitting on your ass investing.” Again, research and learning is constant, but portfolio activity is not.

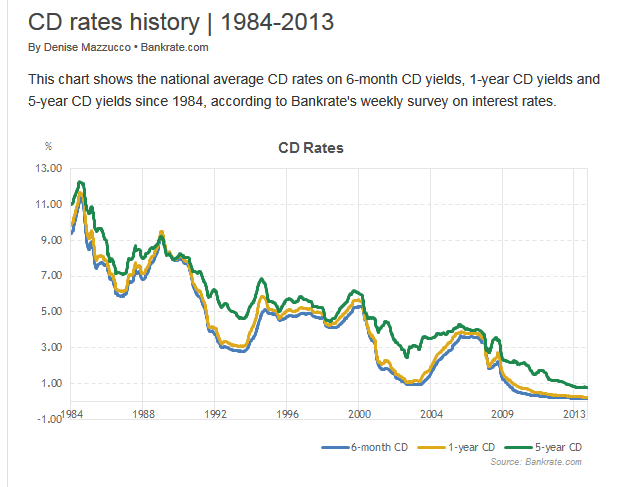

5. The rule of 72 is a generic and back of the envelope way to estimate how long it will take to double your money with a specific rate of return. Numerator is 72, denominator is rate of return, and results follow:

Here are some examples:

| 3 Month Treasury | 10 Year Treasury | 5 Year CD | |

|---|---|---|---|

| Historical | 6 % or 12 years to double | 6 % or 12 years to double | 6 % or 12 years to double |

| November 16, 2015 | 0.113% or 637 years to double. Just a few weeks back it was .01% and for a few days 0.00%. At last conference rate was 0.013% or 5,538 years to double. | 2.28% or > 31 years to double | 2.75% or > 26 years to double |

RBS_2015_Investment_Conference_version_Final

6. The sector is about 23% of our total portfolio. 22% of this is fairly equally weighted in BAC, JPM, C and AIG.

Why do we invest in financials and banks?

A. Net interest margin is lowest level in 10 years. If interest rates rise, net interest margin should go up. This is typically where banks make most of their profit. They borrow cheap and lend with a more expensive rate.

B. Credit quality of these institutions has been and is expected to remain strong. The capital levels and balance sheets are much stronger than they were before and during the financial crisis.

C. I continue to think that the historical low metrics of the banks and major financial institutions are still a victim of fear by investors, and that I think has kept their prices below their historical averages.

D. I think regulators will recognize strength of banks and let them increase the dividends to their shareholders. Regulators remain, and are understandably expected to view the most important of these institutions as to pay out their depositors or the insurance contracts. Shareholders should and will come last.

7. Common Investment approach:

A. A value investor will fly in the face of public opinion. Pure contrarianism.

B. You have to fight human emotions. It is difficult to invest against the momentum of the crowd. Ridicule occurs, and any value investor will second guess themselves as to the current investment which is typically unpopular.

C. You have to fight human emotions.

D. Benjamin Graham once said, “The investors chief problem and an even worst enemy is themselves.”

E. Charlie Munger said, “When it is raining gold, reach for a bucket, not a thimble.”

8. I continually challenge and look to amend our best ideas. I try to kill an investment. What can go wrong? What situation can alter your thesis?

9. Dollar cost averaging in a portfolio is extremely helpful. If you can deposit more into your account on a regular basis, you will be able to take advantage of dips and opportunities.

10. Our typical investment process is as follows:

A. I find an idea, maybe via an article or book I have read, or hear someone discussing something. When my kids were younger I would get ideas just through their daily life. Often an idea occurs when a company I have been looking at for some time, takes a dive, and I will explore that company.

B. I will often start with a smaller allocation, even before research is fully completed. As the research develops, I will often increase our investment, and sometimes, decrease or eliminate that investment. This is a process that has occurred since I started this section over 23 years ago. Yet, our performance numbers have only been monitored for 18 years come the end of 2015. We have been registered with either the State of NJ and/or the SEC since 1995 (20 years).

11. I would like to open up the conference to any questions you may have.

If you have any concerns, please reach out to me. I would be happy to speak with those who are not clients or ours as well. As always, we welcome the opportunity to discuss our outlook and investments with you.

My email is [email protected]

Please feel free to contact me with anything you would like to discuss. Feel free to ask general questions on our Facebook page as well.

You can also follow me on twitter http://www.twitter.com/rbco as well asyou can follow us on Facebook http://www.facebook.com/RedfieldBlonsky

Respectfully submitted,

Ron Redfield

Ronald R. Redfield cpa, pfs

Redfield, Blonsky & Starinsky, LLC

1024 South Avenue W.

PO Box 2069

Westfield, NJ 07091-2069

https://www.facebook.com/RedfieldBlonsky

908 276 7226 phone

908 264 7972 fax

Disclaimer

If you are a client of ours, and if you have questions regarding the company or investment mentioned in this report please call our office. If you are not a client of Redfield, Blonsky & Starinsky, LLC Investment Management Division and are reading these notes, we urge you to do your own research. We will not be responsible for any person making an investment decision based on these notes. These notes are a “by-product” of our research. We are not responsible for the accuracy of these notes. We are not responsible for errors that may occur in these notes. Please do not rely on us to monitor or update this or any other report we may issue. In theory, we could come across some type of data or idea, which causes us to eliminate our long or short position of the company or investment mentioned in this report from our portfolios. We will not notify reader’s revisions to these notes. We are not responsible to keep readers of these notes updated for changes or material errors or for any reason whatsoever. We manage portfolios for clients, and those clients are our greatest concern as it relates to investing. Certain clients of Redfield, Blonsky & Starinsky, LLC may not have the company or investment mentioned in this report in their portfolios. There could be various reasons for this. Again, if you would like to discuss the company or investment mentioned in this report , please contact Ronald R. Redfield, CPA, PFS (partner in charge of investment management division).

Information herein is believed to be reliable, but its accuracy and completeness cannot be guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to change without notice. This publication is provided to you for information purposes only and is not intended as an offer or solicitation. Redfield, Blonsky & Starinsky, LLC and Ronald R Redfield, CPA, PFS, may hold a position or act as an advisor on any investments mentioned in a report or discussion.